Born and bred in Benin City, Steven is a young man who makes his living from art. We learn about his hustle, what he earns, and how he spends money. In this interview, the artist shares his financial story with us:

Steven, what do you do?

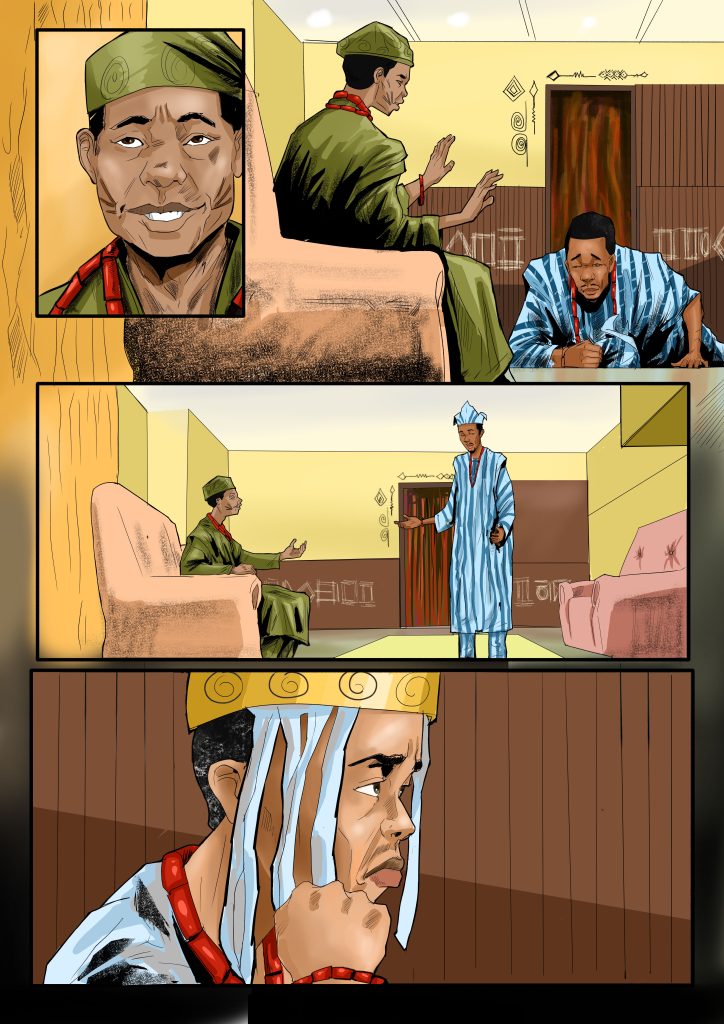

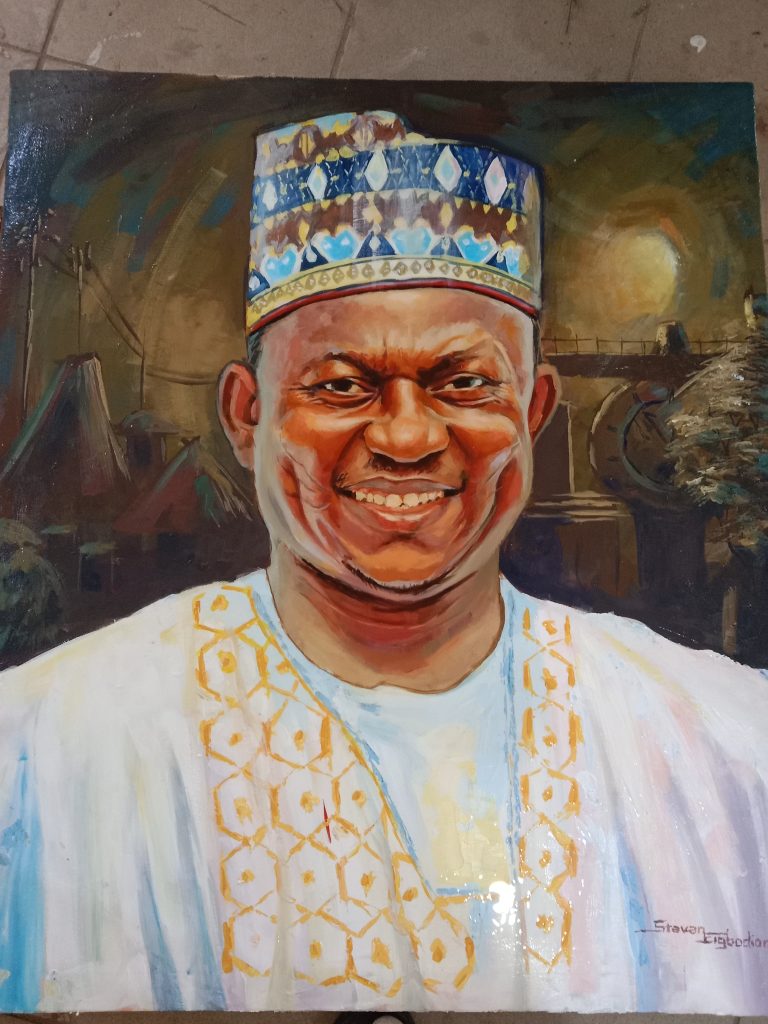

I am a traditional and digital artist and an assistant lecturer at the Kogi State Polytechnic Lokoja. I draw and paint artworks like landscapes, figures, and sometimes abstract art. However, I have spent more time on digital art for quite a while now. I am also a cartoonist, children’s book illustrator, and comic book artist.

How much do you earn?

Oh, this depends on the work or project I am working on. Basically 150k per job at times less and at times more. There is no typical monthly earning on the art… its payment is based on an agreement for a given job.

For now, I have moved completely to doing the comics and cartoons because my clients are not affected and would be demanding the work be done. I only have to sit and make cartoons. The only challenge is I get tired and can’t go out, the zeal to draw diminishes and I will just have to take a break, which sometimes delays the work process.

Well with the current state of things, I’d say I have really found it very difficult when it comes to navigation and getting daily needs. It cripples my work sometimes.

Given the current state of things, would you say it is insufficient, sufficient, or more than sufficient for your lifestyle?

Of course, it’s insufficient due to the fact that the situation we are facing has only raised the cost of survival in this country. Transactions falling and network issues, especially when I’m trying to deal with online customers and clients, or have money transactions with Nigerian clients. All these have in a way slowed down my production and have forced me to only find means to survive.

Though the salary is not changing, the value is not the same. What 50k could do before 100k would barely do today. What 150 could do, now you need 300k to do it and even with poorer results. That’s what I have noticed. So much that my salary which felt like 100- 120k, now feels like 50k. This, I believe is the main issue. As a worker and an artist, I am faced with this current situation. Devaluation of currency that’s becoming more and more detrimental to one’s standard and cost of living further worsens the state of one’s effort to survive in the country. I hope these things would be resolved soon by God’s grace.

What’s one financial principle you live by, Steven?

This is a little hard. I don’t think I have one in particular, but I just get what is very much needed to make me keep working, even though it takes a lot from me. But I try however to spend at a ratio of 20%

Each percentage of the money I make goes for the necessary needs only. 50% is for my well-being, 20% should be for investment, another 20% for savings, and 10% for my tithes. This helps a lot but I’ve not been able to do these during this period. It’s been really demanding.

What’s your ideal figure to earn a month?

Well, it depends again. On a good day, it might sum up to 300k. And possibly more and for some days as low as 108k.

What’s one financial decision you made that you think worked out for you?

Get what would be important enough to get me more money. That is, I go after health, then art materials, and data.

What’s one financial mistake you’ve made, and did you learn from it?

Yes, that’s taking the risk of getting those important things regardless of how impossible it would be to get them looking at the cash at hand. I usually get really down after doing that. I can say It happens most of the time.

I like to think I learn from it. However, in reality, art properties are things one can’t do without.

What are your financial goals for 2023?

Wow, that’s a lot. I just got an apartment. I am looking to equip it for my work. And then try to invest.

What kinds of investments are you looking at?

Well, I’ve not completely made up my mind yet. But by month’s end, I’ll contact a friend who is willing to help me with it.

Nice chat Steven, thank you

You are welcome

Read Ofure’s financial story here.

This awesome and true